Table of Content

NTREIS data may not be reproduced or redistributed and is only for people viewing this site. The advertisements herein are merely indications to bid and are not offers to sell which may be accepted. Dallas is a Sellers Housing Market, which means prices tend to be higher and homes sell faster. The number of new listings is very seasonal in East Dallas, with the spring and summer months much busier than fall and winter. The average percentage of list price received topped out at an all-time high of 105.8% of list price in April of 2022, then retreated to below 100% in September 2022.

More than 80% of the apartments can be rented for less than $1500. The annual vacancy rate of rental properties in Dallas is very low as compared to other cities which is another good reason for investing in the Dallas real estate market. Months inventory for single-unit residential housing rose from 1.3 to 2.3 months. The active listings for residential homes in the Dallas real estate market increased significantly. The number of active listings in the Dallas-Fort Worth-Arlington metropolitan region increased by 68.37% while new listings increased by 2.04%, according to the Texas Real Estate Research Center.

Dallas, TX rent trends

Simply measure and multiply the length and width of each room to get their square footage. The combined square footage of all rooms will give you the property's total square footage. If California, Texas, or New York change housing policies, it can move the whole country's median home price. Home prices have an extensive span, and there are some wildly expensive properties in the United States. A surge in demand for homes in the United States, in addition to limited housing inventory, has created a sellers market unlike anything seen in recent memory.

This can be attributed to the fact that there are more people moving into the city than leaving it and there are many apartments available at affordable prices. The population of Dallas has grown by an average of 193.48% more than the 0.71% average annual rate at which U.S. cities grew over the last 11 years. Based on data from RealWealth, the annual price to rent ratio in Dallas is 17.8. When the price to rent ratio is between 15 to 20, it means it’s better to rent than buy for those considering living in the Dallas metro. Since renting is more affordable than buying here for the typical resident, 59% of households in Dallas rent their homes.

Median Monthly Rent Statistics 2022

In October 2022, active listings in the area were up 32.2% from a year earlier. The 1.9 months of inventory figure is 0.6 months more than the Sept of last year. The new construction in the last 10 years has not been anywhere near enough to handle the population growth in Dallas. In November 2022, Dallas home prices were up 10.6% compared to last year, selling for a median price of $403K. On average, homes in Dallas sell after 32 days on the market compared to 28 days last year. There were 684 homes sold in November this year, down from 1,087 last year.

Click here to discover the cities with the highest number of bedrooms and bathrooms. In contrast, browse here to discover the cities with the fewest number of bedrooms and bathrooms. Moreover, click here to learn about cities with limited square footage. The tool automatically checks for updates from the FHFA and Bureau of Labor Statistics once a week.

Historical US Home Prices: Monthly Median from 1953-2022

This illustrates how common each property type is in Dallas, Texas. The minimum down payment is the cash amount a buyer gives to qualify for a mortgage loan and buy a house. So, it's about as reasonable as looking at any US-aggregated data. I also trust the underlying indices to get us in the actual market's ballpark. I don't know the condo, co-op, townhome, or multi-family market well enough to try to create proxies.

This is nearly triple the national average growth rate for jobs during that time period. Dallas has seen a lot of growth in its job market over the past year. The Department of Numbers reports that Dallas added 303,300 jobs from May 2021 to May 2022—a whopping 7.99% increase in the number of jobs in Dallas over the course of the year. Login to our Realty Portal where you can learn more about investing in single family properties as well as 2-4 unit multi-family properties. You can also watch webinar replays, view sample proformas and connect with property teams. The database information herein is provided from and copyrighted by the North Texas Real Estate Information Systems, Inc.

United States Median Home Price History

The most popular neighborhood in Dallas is Uptown Dallas, where there are 32 listings with an average rent of $2,335. In November 2022, Fort Worth home prices were up 7.9% compared to last year, selling for a median price of $340K. On average, homes in Fort Worth sell after 36 days on the market compared to 19 days last year.

The housing supply is tightest at the lower end of the pricing spectrum. There are more house hunters and buyers on the more affordable end as compared to the higher end. As a result, what do you think the Dallas real estate market will look like in 2022 and 2023? Among the most affordable real estate markets in the state of Texas, Dallas is one of the most affordable. It is also one of the most active real estate markets in the country for renting out properties.

The listing broker’s offer of compensation is made only to participants of the MLS where the listing is filed. The neighborhoods in Dallas must be safe to live in and should have a low crime rate. The neighborhoods should be close to basic amenities, public services, schools, and shopping malls. A cheaper neighborhood in Dallas might not be the best place to live in.

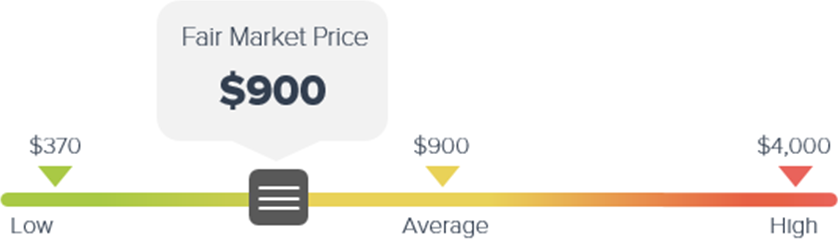

Houses in Dallas, TX rent between $475 - $30,000 with a median rent of $1,999. We created a seamless online experience for you - from shopping on the largest rental network, to applying, to paying rent. If this forecast is correct, DFW home prices will be higher in the 3rd Quarter of 2023 than they were in the 3rd Quarter of 2022. The total days on market equaled 62 — 2 days more than Oct 2021.

There should be a natural and upcoming high demand for rental properties. Demand would raise the price of your Dallas investment property and you should be able to get a good return on your investment over the long term. If you have decided to invest in Dallas, you can either buy a fixer-upper or you may want to buy a Dallas investment property. This market offers a wide range of turnkey investment properties; you just have to find your tenants to rent out the property.

The result is an attractive rental property market for domestic and international investors alike. According to the Texas Association of Realtors, around one-third of international investors come from Latin America, just ahead of those from Asia. European buyers make up around one in 10 buyers, while Indian buyers are also a notable presence in the Texas real estate market. The typical home value of homes in the DFW metro is currently $390,152. It indicates that 50 percent of all housing stock in the area is worth more than $390,152 and 50 percent is worth less . The median sales price increased by 11.1% YoY to $350,000 in Sept 2022.

No comments:

Post a Comment